Syncing operations and accounting

Syncing operations and accounting

I have worked with many condo boards, and I’ve recognized a pattern. All plans look solid on paper, but something still goes wrong. You have got a decent team, clear service protocols, and maybe a management company handling day-to-day operations. But expansion plans stall out, administrative tasks take longer than they should, and reports come in late or incomplete.

What I have learned after many years in this space is that the problem usually isn’t your people or your processes. It’s your system. When your billing platform doesn’t communicate with your management software, when your maintenance requests live in one system while your financial records live in another, that’s when things start breaking down. And this kind of problem doesn’t show up on your quarterly reports until it’s already cost you.

Let me share some numbers that made me rethink how we approach system integration. Gartner found that poor data quality costs an average of 12.9 million from organizations annually. I know most condo communities aren’t operating at that scale, but the principal holds. A Forrester consulting report revealed something even more startling: employees waste up to 12 hours weekly just searching for information. Think about that. From projects to documents to residents’ files to governing policies, your team can lose 30% of their time trying to locate what they need.

The problem gets worse as data ages. Old spreadsheets with outdated contact information, maintenance records that never made it into the system, and payment histories are all scattered across multiple platforms. Here’s the flip side: associations that successfully integrate their management platforms, financial systems, and operational tools recapture 10 to 30% of previously lost revenue each year. That improvement comes through enhanced transparency, automation, and access to real-time information for decision-making. In my experience, once you see how much time and money you are losing to disconnected systems, the case for integration becomes pretty clear.

Why operations and accounting end up in silos

Let me walk you through how this separation typically develops, because understanding the root cause helps prevent it. The operational side of your association and the accounting side represent two of the most common areas affected by silos. Operations personnel interact with the residents directly; they are handling service requests, coordinating maintenance, and managing amenities. They generate revenue and keep the community running day-to-day.

Many operations staff understand complex maintenance problems and can coordinate community events without breaking a sweat. Meanwhile, your accounting team typically functions as a back-office support. They rarely interact with the residents and often stay within their own sphere. Few accounting professionals understand field operations firsthand, and many have never visited community facilities to see how maintenance actually works.

Here is what happens: operations blame accounting when invoices don’t go out on time. Accounting faults operations when service orders aren’t documented properly. Both perspectives have merit, but both are also missing the bigger picture. The real issue? When each team operates from separate platforms, collaboration deteriorates. Departments pursue their own metrics rather than collective organizational goals.

Leadership teams without access to reliable, current data become reluctant to make major strategic decisions. Growth stagnates not from lack of opportunity, but from uncertainty about whether the numbers you are looking at are actually accurate. I have seen this play out too many times, and the answer is always: sync operations and accounting.

What integration actually delivers

Let me break down the practical benefits I have seen when condo communities implement integrated systems.

Unified financial dashboard

We have all experienced scattered financial data. You log into your bank portal, then your credit card account, then your investment platform, then your accounting software, then your payment processor, just to get an accurate picture. It is exhausting. For condo communities, having a centralized location to view financial data proves crucial. An integrated accounting platform brings all these separate functions together into one comprehensive view. With everything readily available, you can develop projections and make strategic decisions with greater confidence. No more waiting 3 days to reconcile accounts across the systems before you can answer a board member’s question.

Transaction automation

In my experience, one of the biggest time savers is eliminating manual transaction logging. When you process a payment or receive an assessment, an integrated platform logs transactions from your financial institution or credit cards directly into a general ledger and updates financial reports simultaneously. The team stops spending hours on data entry and starts focusing on analysis and resident service.

Error reduction

One thing that I always remind boards is that humans make mistakes. Transposition errors, placing information in incorrect spreadsheet columns, accidentally crediting an account instead of debiting it, are just some of the common accounting errors that I have seen cause serious headaches. Automation guarantees accurate transaction recording and transfer, minimizing errors on your balance sheet. When your systems talk to each other, the data only gets entered once, correctly.

Reliable financial reporting

Because an integrated financial platform automatically aggregates information across accounts and platforms, your balance sheet, cash flow statement, and other financial reports remain constantly viewable or easily generated with a button click. Real-time financial visibility makes reporting more accurate and ensures you have the most current information for your stakeholders. When a unit owner asks about the reserve fund balance during a board meeting, you can pull it up immediately instead of promising to circle back after you check the numbers.

Critical sync points to get right

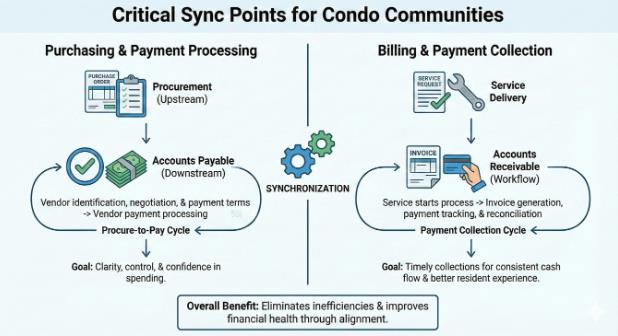

Based on what I have seen work and what doesn’t, here are the areas where synchronization matters most.

Purchasing and payment processing

Accounts payable is simply the connection between procurement and vendor payment. This P2P pipeline functions bidirectionally, managing both upstream and downstream workflows. Upstream is where procurement occurs, identifying appropriate vendors, monitoring risks, and negotiating payment terms with suppliers.

In most associations, procurement and accounts payable departments operate independently. This siloed environment partly stems from differing objectives, where procurement maintains operational focus, while AP’s focus remains financial. But here is what I tell boards: these two departments share more than most people acknowledge. Both ultimately work to strengthen your cash flow and financial performance.

Imagine trying to manage household finances without knowing who is making purchases or when bills come due. That is the reality when procurement and accounts payable teams work in isolation. Purchases occur, invoices accumulate, and nobody quite knows if the budget remains on track.

Procurement manages what your association purchases, while AP controls how and when payment gets processed. Together, they form the purchase-to-pay cycle, where each procurement request eventually becomes a paid invoice, tracked and verified for compliance and accuracy.

In any procure-to-pay process, there is a natural synchronization opportunity when procurement transfers the purchase order and related documentation to accounts payable. A more efficient approach involves expanding that synchronization to the complete P2P lifecycle, creating a role for AP in procurement and a role for procurement in AP.

When procurement and accounts payable operate synchronously, finance teams get what they have consistently desired: clarity, control, and confidence in every dollar spent. These alignment transfers fragmented workflows into a single, streamlined engine that powers better decision-making.

Integration benefits include reduced costs and increased savings, primarily through workflow improvements. By shortening the time and steps necessary for purchasing, invoice management, and the payment life cycles, you reduce processing expenses. By implementing AP automation and integrating AP payments within your end-to-end platform, you can:

- Automate invoice verification and approval workflows, eliminating duplicate payments and minimizing manual data entry errors.

- Implement sophisticated analytics and fraud detection algorithms to identify suspicious activities.

- Establish a comprehensive audit trail for simplified payment history tracing.

- Enforce separation of duties, minimizing the potential for insider collusion.

This alignment also elevates the quality of financial information, ensuring that all data related to invoices, purchase orders, vendors, and payments remain accurate, consistent, and current. You can minimize exceptions, reduce rework, and potentially cut invoice processing costs by up to 89%.

Billing and payment collection

The accounts receivable workflow represents a systematic series of processes your association follows to track and manage payments owed by residents. It typically starts once a service gets delivered and continues until the payment gets collected and reconciled in your association’s records. Timely collections prove vital for maintaining consistent cash flow.

I have seen delays in AR trigger cash flow shortages that complicate paying vendors, employees, and other operational expenses. The AR process workflow encompasses invoice generation, transmitting invoices to residents, tracking payments, applying cash receipts, managing collections, and reconciling accounts. Each step ensures prompt billing and collection, effective credit management, and proactive follow-up on overdue accounts.

Here is something important that often gets overlooked: AR teams typically get benchmarked on their payment collection ability. However, residents are more likely to comply with payment terms if those terms are discussed upfront with the operations team during the move-in process. Your operations team should review payment terms with residents to ensure they acknowledge them and commit to meeting the payment schedule. Should a resident payment become past due, this acknowledgment and confirmation can serve as valuable leverage to secure quick payment.

Also, when your AR team struggles to obtain responses from a resident’s payment contact, your AR manager can request the operations team to contact their family or a friend for assistance. This means the AR team relies on the efficiency of the operations team. But when you synchronize operations with accounting, the operations team actively enrolls new residents into the resident portal. Collecting payments from residents via an online payment portal significantly expedites the cash application process because the residents can clearly identify which fees they are paying independently. And when your payment portal integrates directly with your condo management system, you can post the transaction to your ledger automatically.

In my work with condo communities, I have seen this integration reduce collection times massively. Residents appreciate the convenience, accounting appreciates the accuracy, and board members appreciate seeing the cash flow improve.

Technology solutions that actually work

Let me talk about what makes a good technology foundation for all this. The utilization of an end-to-end condo management software like Condo Manager helps associations operate more effectively by establishing a common data source connecting the finance side to operations. It shares the same current information with finance and accounting teams to improve accuracy and efficiency around budgeting, forecasting, reporting, procurement, project management, governance, risk, and compliance.

End-to-end systems streamline processes and centralize information, providing a unified platform for managing daily activities. This ensures that everyone in accounting and operations accesses the same current information, enhancing collaboration and improving decision-making throughout your community.

Finance and accounting teams then use this information to conduct analysis and planning, and share the results in meaningful and actionable ways. For instance, a unified condo management system can help organize who your residents are, what they owe, and how frequently they make payments. It can integrate with the vendor management systems to intelligently manage your operations. It can help teams in finance and across the association conduct forecasting and budgeting based on the most current information.

Also, a unified, integrated system reduces IT costs and simplifies system management since you won’t be managing multiple software platforms and multiple subscriptions. By consolidating tools into one platform, you reduce maintenance expenses and complexity.

However, and this is important, to realize the complete benefits of a unified system that synchronizes operations and accounting, you need to implement a comprehensive system specifically designed for community association operations and accounting. Generic management systems miss critical nuances of how condo communities actually operate. You want specialized association management software that understands your unique workflows.

How to actually implement this

I get asked about implementation constantly, so let me walk you through what a realistic rollout looks like. An end-to-end implementation represents the process of integrating a condo management platform into all departments of your association, from finance and human resources to operations and more. The process involves several critical stages, including software installation, data migration, process mapping, and user training. Most implementation plans can be separated into phases, with each phase concentrating on different project objectives.

The discovery and planning phase

The first phase involves assembling a project team, researching and identifying a unified system, determining system requirements, and developing a project plan.

- Do you want software installation on premises, or are you seeking a cloud-based solution?

- What features and capabilities should the system possess?

In my experience, cloud-based solutions offer significant advantages for condo communities, such as automatic updates, accessibility from anywhere, and lower upfront costs. The implementation project team works to discover system requirements and select a platform solution.

I strongly recommend you opt for a specialized platform designed for condos and community management, such as Condo Manager, instead of general-purpose ERPs. It makes the remaining steps considerably easier because the software already understands your workflows.

The implementation costs and the budget forecast phase

What is your budget? That is the golden question. If it were simple to answer, there would be far fewer over-budget platform implementations. According to industry studies:

- 35% of software projects exceed the budget by 0 to 25%

- 15% run over budget by 26 to 50%

- 6% exceed the budget by more than 50%

This suggests that over half of software implementations run over budget. I always recommend a good starting point of assuming the cost of a software implementation will require at least 1% of your association’s annual gross revenue at a minimum.

The design phase

The project team determines what the system will look like, how it will be utilized in the community, and what settings are necessary for successful integration. The project team should work with stakeholders to obtain a complete picture of processes and challenges.

Analyze to determine what customizations the system will need to undergo so it seamlessly integrates into your existing workflows. If the platform is already specialized for community associations, it will require very minimal customizations. The implementation team also documents new workflows and standard procedures that will be necessary for employees to correctly use and fully leverage the new system.

In my experience, this documentation phase often gets rushed, and that creates problems later. Take the time to map out how information actually flows through your community, not how you wish it flowed.

Data migration

The focus now is on the quality and integrity of your association’s data before it gets moved to the new system. I always tell boards that this is where you clean the house. You need to:

- Audit current records for inaccuracies and duplicates

- Standardize data formats for quality consistency

- Cleanse data to ensure correctness

- Create comprehensive and secure backups

The actual data transfer and testing can require one to two weeks, depending on the volume of data and the complexity of integrations. Don’t rush this. Bad data migrated to a good system is still bad data.

Deployment

This is what you have been working toward: the day the system goes live. Be ready for potential issues, since there may be numerous moving parts and possibly some confused employees and board members, despite your best efforts to prepare them for the change. Here is my tip: identify promising, tech-savvy members of your staff to train as system superusers. They can then handle low-level user issues, allowing you to focus on bigger challenges.

For best results, consider gamifying portions of your training plan. In a study by TalentLMS, 89% of those surveyed stated that a point-based system would boost engagement, while 62% said that leaderboards and the opportunity to compete with colleagues would motivate them to learn. Use this to your advantage.

The project team should answer questions, help users understand the system, and attempt to resolve any issues. Your implementation partner should be able to help with the troubleshooting if necessary. Remember that it may require time for users to adapt to the new system and achieve the anticipated productivity gains.

Go-live activities

The system go-live phase marks the culmination of your hard work. This is when you flip the switch, and your association begins running much better on your new platform. Check with the vendors and service providers to be sure any portals they depend on still function with the new system.

Does anyone in those departments need training? As a rule of thumb, assume that your new platform help desk will receive approximately one ticket request for every two end users on the first day of go-live. This is a number you can use for initial planning, and adjust based on how rushed or leisurely the final days of the implementation are, how integration testing goes, and how many processes still have bugs at the go-live stage.

I have been through several implementations, and I can tell you that the first week is always challenging. But if you have done the preparation work properly and chosen the right platform, things stabilize quickly.

Conclusion

By aligning operational management with accounting functions through integrated technology, community associations can eliminate inefficiencies, improve financial accuracy, enhance decision-making capabilities, and ultimately provide better service to residents while protecting the association’s financial health. I have seen these transformations happen. Boards that were drowning in spreadsheets and disconnected systems suddenly have clear visibility into the operations. Management teams that were spending lots of time chasing down information can now focus on strategic planning. Residents who were frustrated by slow responses and billing errors start seeing faster service and accurate statements.